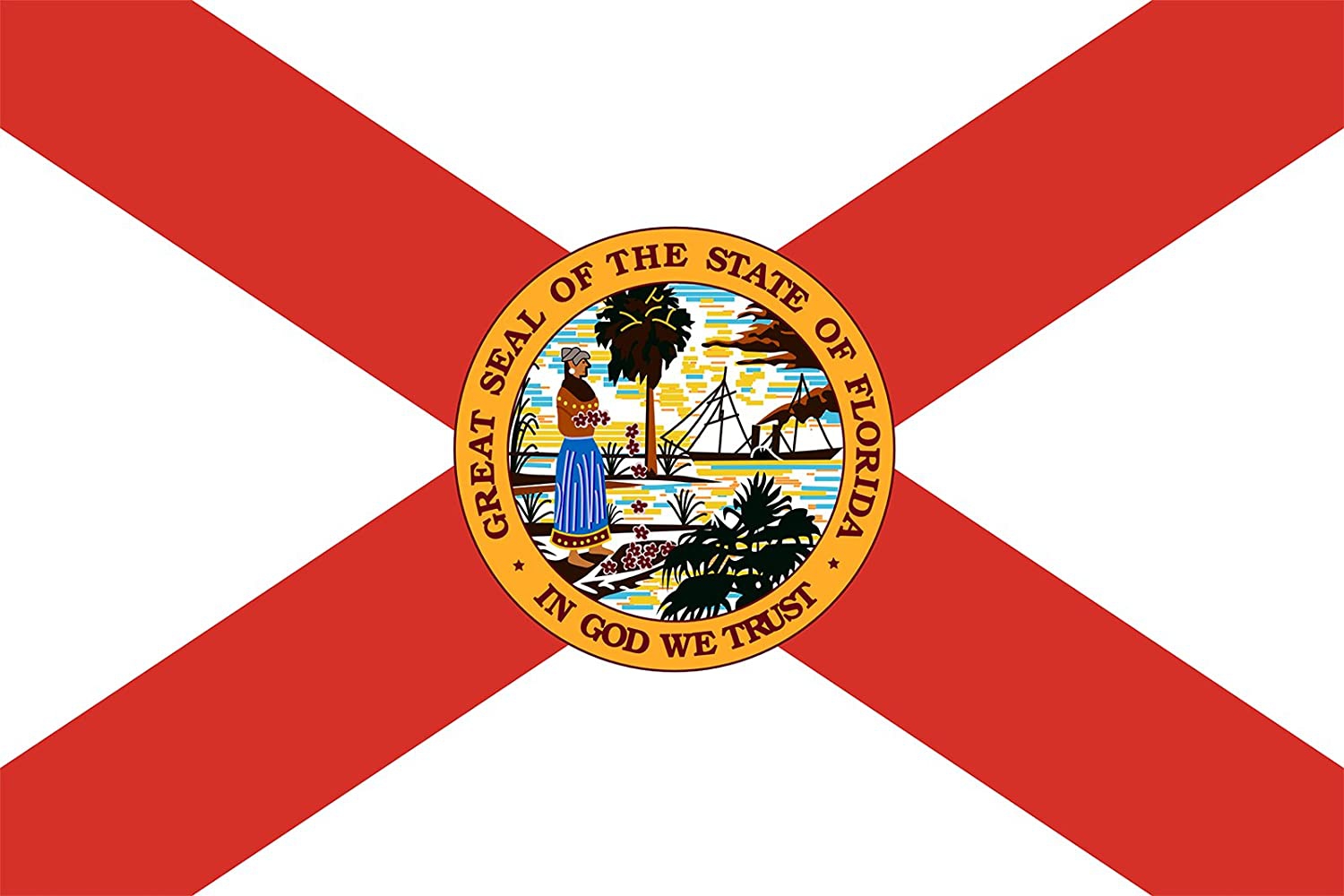

Becoming a Resident

Actions to establish residency in Florida:

File a Declaration of Domicile: File a Declaration of Domicile within the Office of the Receptionist of the Circuit Court in which you proposed to dwell.

Apply for a Homestead property tax exemption: Qualify for the estate property charge exception on the off chance that you possess your Florida home.

Register to Vote: Contact the County Supervisor of Elections for residency necessities for voting and after that enroll.

Indicate intent to establish residency:

Florida driver’s license: Obtain a Florida driver’s license and plates for your automobile.

Income tax returns: File future Federal income tax returns using your Florida address. In case you have got wage sourced in a state exterior of Florida, file a nonresident wage charge return within the state of the sourced pay in case that state has a person salary charge.

Wills and estate planning: If you do not have a will or you have a will executed in your former state of residence, contact an attorney to draw a will declaring Florida as your state of legal residence. Execute your estate planning documents in Florida.

Tax agency: Notify taxing officials of your change of residence by either calling the state’s Department of Revenue or, if your state of former residence has a change of address form, filing the change of address form. Most states’ part-year resident returns provide a place on the return to indicate your period of residency ending within the tax year.

Physical presence: Be physically present in Florida for more than half of the year. Own or lease, and occupy, a dwelling in Florida.

Stocks and ownership interests: If you own corporate stocks or own a Partnership/LLC interest outside of a broker account, notify the entities of your change of residence. Exchange monetary accounts from your state of previous home to Florida. Alter your mailing address to Florida for any out-of-state accounts you keep up.

Safe-deposit box: Rent a safe deposit box in Florida to hold all your valuables.

Contracts and other documents: In all future contracts and other documents containing reference to your state of residency, citing Florida as your state of residency.

Club memberships: Pull back enrollment in any club exterior of Florida in the event that a prerequisite of participation incorporates residency inside the state of the club’s area. Alter an out-of-state club enrollment to a “nonresident” enrollment, when conceivable.

Business: Transact business in Florida.

Social Security: Notify the Social Security Administration of your change of address.

Passports: Use your Florida address for your passport.

Credit cards: Use your Florida address for your charge accounts.

Insurance: Register your Florida address with your insurance company and Medicare.

Checks: Have all income, pension, dividend/interest checks, and other payments mailed to your Florida address.